Palantir Stock Keeps Hitting New All-Time Highs

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

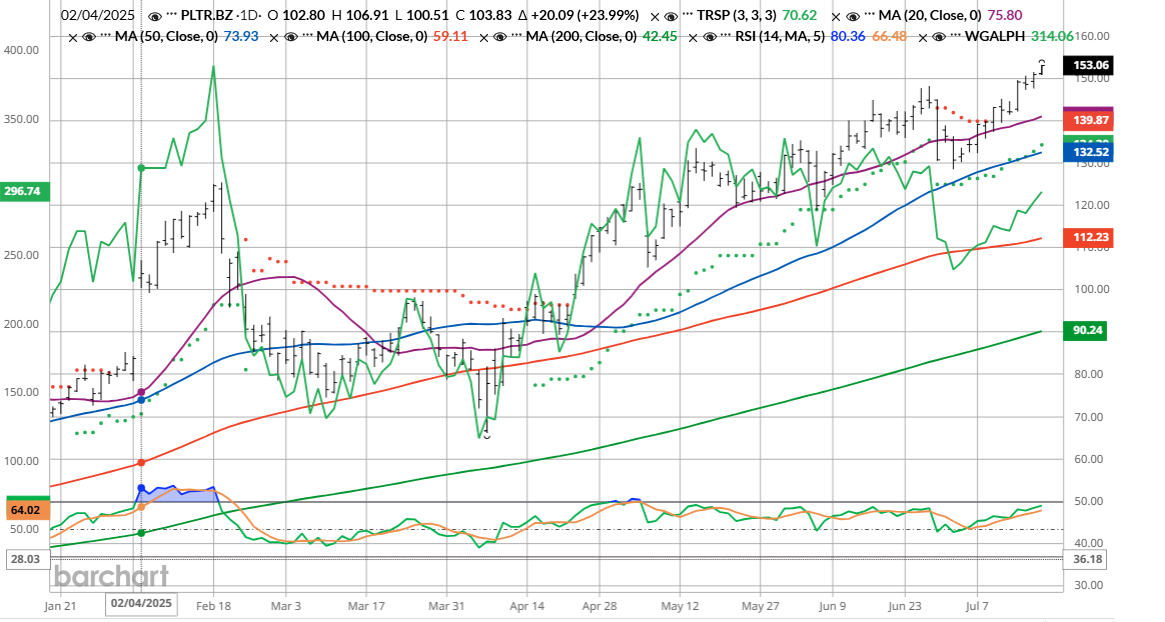

- Palantir (PLTR) hit a new all-time high of $153.15 in morning trading on July 17.

- PLTR shares have a 100% technical “Buy” signal via Barchart.

- Shares have been red hot in 2025, more than doubling in the year to date.

- Palantir has been a leader in the artificial intelligence rally and has grown its revenue and earnings impressively, but its valuation is sky high.

Today’s Featured Stock

Valued at $356 billion, Palantir (PLTR) is currently one of the hottest stocks on Wall Street. The big data company serves both government and commercial clients, with products such as Gotham, Foundry, and the Artificial Intelligence Platform (AIP) aiding in data analysis, decision making, AI-based business optimization, and more. Investors commonly associate Palantir with its work supporting the U.S. military, police, and broader intelligence community.

Palantir is the top-performing S&P 500 Index ($SPX) stock so far in 2025.

What I’m Watching

I found today’s Chart of the Day by using Barchart’s powerful screening functions. I started by using Barchart’s New Highs & Lows tool (watch more on how to find winners using it here). I then sorted for stocks that have the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal. Since the Trend Seeker signaled a buy on July 9, PLTR stock is up 5.4%.

PLTR Price vs. Daily Moving Averages:

Barchart Technical Indicators for PLTR

Editor’s Note: The technical indicators below are updated live during the session every 20 minutes and can therefore change each day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report. These technical indicators form the Barchart Opinion on a particular stock.

- Palantir shares hit a new all-time high on July 17, hitting $153.15 in morning trading. The 50-day moving average is at $132.50.

- Palantir has a 100% technical “Buy” signal.

- PLTR has a Weighted Alpha of +293.42.

- The stock has gained 437.9% over the past year.

- Palantir has its Trend Seeker “Buy” signal intact.

- PLTR is trading above its 20, 50 and 100-day moving averages.

- The stock has made nine new highs and gained 9.8% in the last month.

- Relative Strength Index is at 63.86%.

- The technical support level is $148.55.

Follow the Fundamentals

- Palantir’s market capitalization is $356 billion.

- First-quarter revenue was up 39% year-over-year and its diluted earnings per share doubled, continuing a pattern of estimate-beating performance.

- Analysts forecast 42% earnings growth for 2025 and 36% annual revenue growth.

- Palantir trades at a forward price-earnings ratio of 406.5x.

The Bottom Line

Palantir has stunned Wall Street with its share-price outperformance and its rapid rise into artificial intelligence stardom.

Investors have historically worried about its reliance on government customers, especially as efforts under President Donald Trump this year have focused on trimming government spending and cutting relationships with contractors. But Palantir has continued to score contract wins, expanding its relationships with the U.S. military, NATO, and more in recent months. Many on the Street now see it as leading a new era of defense spending, defined by nimbler, tech-focused solutions.

Palantir has also successfully ramped up its commercial business. In the first quarter, its commercial revenue grew 71% annually and hit a $1 billion run rate. It has expanded relationships across the healthcare, energy, and finance verticals, just to name a few, and has positioned itself as the AI company of choice for corporate partnerships.

However, Palantir’s valuation is astronomical, and has been a hard pill for many investors and analysts to swallow. At 406 times forward earnings and 122 times sales, there’s no comparison. Nvidia (NVDA), which has also been a star stock, trades at “just” 42.6 times forward earnings.

Given this valuation, analysts are neutral on PLTR with a “Hold” consensus rating. The stock has far surpassed the average price target at $106.12 and is just 5% off its Street-high price target of $160.

Today’s Chart of the Day was written by Sarah Holzmann. Read previous editions of the daily newsletter here.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.