Analysts Love This Key AI Stock Trading at an ‘Inflection Point.’ Should You Buy Shares Here?

/The%20Twilio%20logo%20on%20a%20smartphone%20screen%20with%20stock%20charts%20in%20the%20background_%20Image%20by%20Piotr%20Swat%20via%20Shutterstock_.jpg)

Twilio (TWLO) has been arguably the most volatile of the software bunch, but new analyst coverage is saying its story is just beginning to round the corner. Rosenblatt Securities initiated coverage with a “Buy” and $140 target and cited Twilio’s “critical importance as the ‘communications backbone for the AI ecosystem’ and the company’s growing focus on shareholder return.” That endorsement sent shares up slightly within last Friday’s premarket movement.

The results arrive amid real financial acceleration for Twilio. A decade-long investment is finally paying off with accelerating revenue growth, widening margins, and material free cash flow generation. The key question for investors is if it is a sustainable shift that can recover Twilio back into the favor of Wall Street after a rocky two years of underperformance.

About TWLO Stock

Twilio provides cloud communication solutions for top organizations, and it enables organizations to add voice, message, video, and authentication to their applications. Twilio is based in San Francisco, California, and it has a market capitalization of roughly $16 billion currently.

The share rebounded forcefully from the lows of the previous year, climbing from $58.76 to as high as $151.95 over the past 52 weeks, only to settle back around $103 today, Sept. 11. Despite the rebound, shares remain dramatically lower than pandemic-era highs. Comparably, the Nasdaq Composite Index ($NASX) gained more steadily throughout the year, signifying the greater volatility of Twilio.

In valuation terms, Twilio has a high trailing and forward multiple of 77.54 and 63.78, respectively. Expensive compared to the vast majority of software peers, the multiples are sustainable based on the accelerating growth of profitability. A multiple of 3.68 versus the sales reveals renewed confidence in top-line growth, and a multiple of 43.6 on the price-to-cash flow reveals the premium investors are willing to pay for free cash growth. Debt is under control with a debt-to-equity ratio of 0.12.

Unlike mature software businesses, Twilio is not paying a dividend, and management is electing to reinvest for growth and higher margins.

Twilio Beats Earnings

Twilio’s second quarter of the year 2025 was a definitive pivot point. The company reported $1.23 billion in revenue, an increase of 13% year-over-year (YoY), led by growth of 14% in its core Communications business. Active customer accounts increased to over 349,000 compared with 316,000 a year ago, and its dollar-based net expansion rate went up to 108%, a sign of increased interaction within existing customers.

Quarterly net income under GAAP was $0.14 per share versus the loss of $0.19 per share the company experienced last year, and non-GAAP earnings totaled $1.19 per share versus $0.87 reported last quarter for Q2 2024. Free cash flow also improved, reaching $263.5 million versus $197.6 million last year, a clear indication the investment years for Twilio are reaping tangible dividends now.

The firm centered on its rising operating leverage, with GAAP operating income of $37 million compared with last year's $19 million loss. Non-GAAP operating income increased to $220.5 million from $175.3 million, showing improved efficiency at scale. With industry-wide demand being driven by applications for artificial intelligence, Twilio is broadly positioned for mid-teens revenue growth and expanding profitability.

What Are the Forecasts for TWLO Stock?

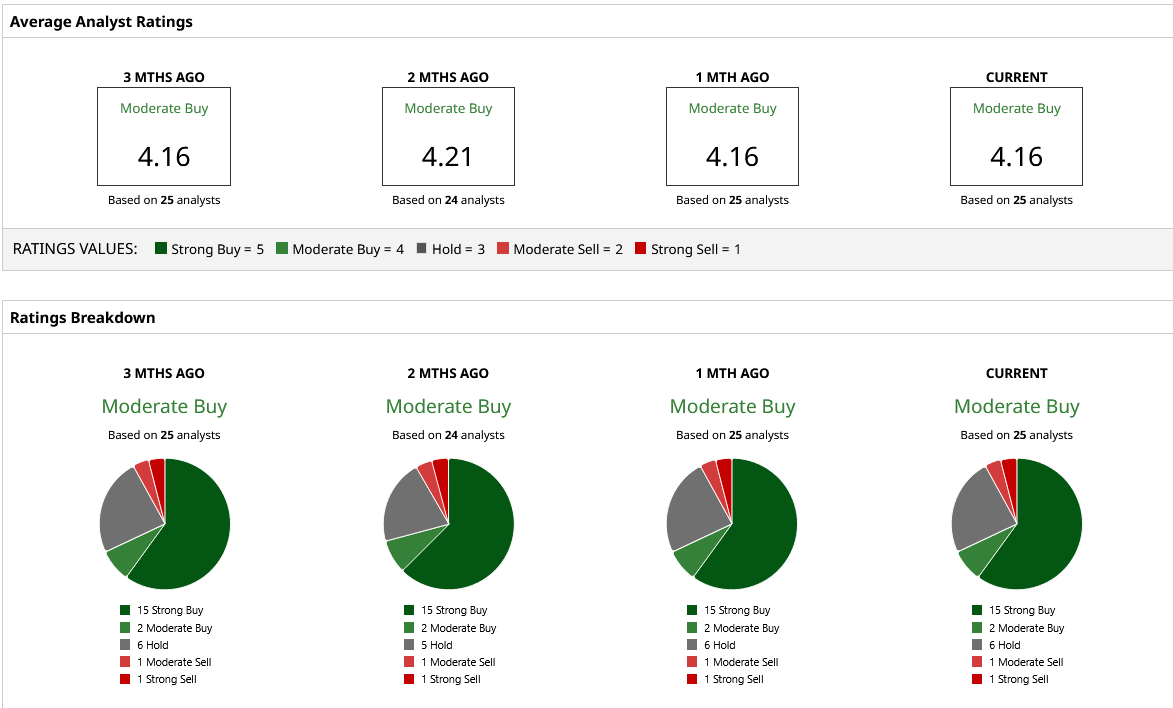

Rosenblatt's initiation contributes to a broadly positive consensus for Twilio. TWLO has a consensus “Moderate Buy” rating from the 25 analysts covering it and a mean price target of $131.79, implying upside of 22% from the current position. Price targets vary widely, from a high target of $170 for the bulls to a low target of $75 for the bears, with the full spectrum of sentiment reflecting ongoing concerns related to execution.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.